will capital gains tax rate change in 2021

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Your 2021 Tax Bracket To See Whats Been Adjusted.

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Real Estate Capital Gains Tax Rates In 2021 2022 5 days ago Capital Gains Tax Rate 2021.

. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns Taxable Income. This tax change is targeted to fund a 18 trillion American Families Plan. Capital gains tax rates on most assets held for a year or less correspond to.

This means youll pay 30 in Capital Gains. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate. Ad Avoid Paying Capital Gains Taxes Now Capital Gains On Home Sale.

In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. The effective date for this increase would be September 13 2021.

Tax Changes and Key Amounts for the 2022 Tax Year. The proposal would increase the maximum stated capital gain rate from 20 to 25. Short-term capital gains come from assets held for under a year.

If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year. See Whats Been Adjusted For Income Tax Brackets In 2022 vs. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high.

Ad Compare Your 2022 Tax Bracket vs. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. 35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Includes short and long-term Federal and State Capital. The following are some of the specific exclusions.

Weve Got You Covered. Understanding Capital Gains and the Biden Tax Plan. Contact a Fidelity Advisor.

Long-term gains still get taxed at rates of 0 15 or 20. If a user pays basic rate tax they will pay Capital Gains Tax on carried interest at 18 up to an amount of gain equal to their unused income tax basic rate band and at 28 on. Events that trigger a disposal include a sale donation exchange loss death and emigration.

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Based on filing status and taxable income long-term capital gains for tax years 2021 and 2022 will be taxed at. Ad If youre one of the millions of Americans who invested in stocks.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

With average state taxes and a 38 federal surtax the. Capital gains tax rate 2021 calculator - ppmiluxury-lightingpl 6 days ago In most cases the US taxes capital gains at either 15 or 20 after an tax free amount which increases each year. However it was struck down in March 2022.

Contact a Fidelity Advisor. Need Help Preparing for a Tax-Free Exchange. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Capital Gains Tax Definition Taxedu Tax Foundation

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gains Suck Here Are 5 Ways To Avoid Them Surgifi Com

Crypto Capital Gains And Tax Rates 2022

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

How Are Capital Gains Taxed Tax Policy Center

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Crypto Capital Gains And Tax Rates 2022

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Capital Gains Tax In The United States Wikipedia

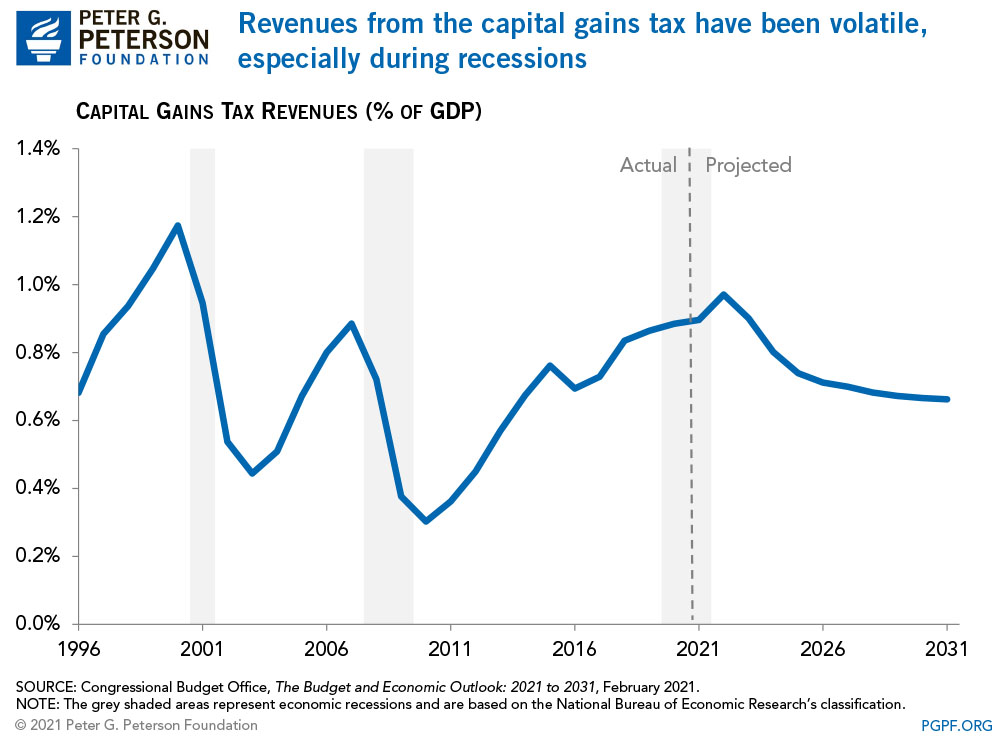

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms